As property owners across Burnaby receive their 2025 assessment notices from BC Assessment this January, some will notice changes to their property’s assessed value compared with last year.

It is important to understand how assessments affect – and do not affect – the property tax bill you will receive later this year.

Initial 2025 assessed values of residential properties in Burnaby show an increase of 1.12% on average.

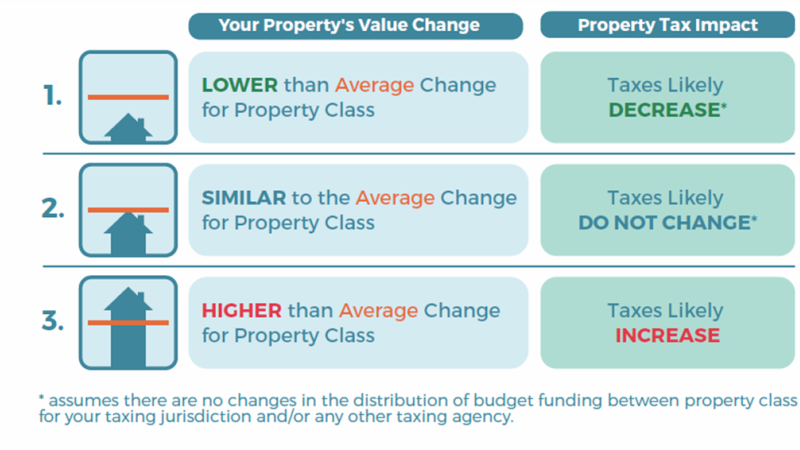

The most important factor in determining how much you will pay in property taxes is not how much your assessed value has changed, but how the assessed value has changed compared to similar properties in Burnaby.

For example, if the assessed value of your home in Burnaby decreased, or increased by 1% or less, you may actually see an overall decrease in your property taxes, since your property increased by less than the 1.12% average assessment increase for residential property in Burnaby.

Or if the assessed value of your home went up by 1.12%, which is the same as the average increase for residential properties, the change to the City’s portion of your property tax bill will be closer to the annual budget percentage increase.

There are helpful resources online to learn more about property taxes and assessments.

Find more helpful explanation examples from BC Assessment or visit their website or watch the City’s helpful explainer video to learn more about how your property taxes are calculated each year.